93 Chew Valley Road, Greenfield

Saddleworth

OL3 7JJ

New Earth Street, Oldham

£123,000 Sold (STC)

2 Bedroom House - Terraced

- IDEAL FOR INVESTORS OR FIRST TIME BUYERS

- 2 BEDROOM

- MID TERRACE

- POPULAR LOCATION

- LOCAL NURSERY, PRIMARY & HIGH SCHOOLS

- KITCHEN/DINER

- LOCAL MOSQUE

**NEW PRICE**CHAIN FREE** **IDEAL FOR FIRST TIME BUYERS/ INVESTORS** **KITCHEN/DINER**

McDermott & Co are pleased to bring to the market this two bedroomed mid terrace property which is a perfect opportunity for first-time buyer or BTL investors. Situated in a popular and convenient location the internal accommodation briefly comprises of vestibule entrance leading into lounge, kitchen/diner, 2 double bedrooms and main family bathroom. Externally offers a private paved rear yard. Warmed by gas central heating and further benefits Upvc double glazing. Situated in very close proximity to local amenities such as day nursery, primary & high schools and a mosque. Fantastic transport links. Viewings highly recommended.

Entrance Vestibule

1.17m x 1.07m (3'10 x 3'6 )Vestibule entrance, carpeted, neutral decor, door leading to lounge.

Lounge

3.66m x 4.06m (12'0 x 13'4 )Front Facing, carpeted, electric fire, Glass sliding doors leading to kitchen/diner

Dining Kitchen

4.11m x 4.09m (13'6 x 13'5 )Rear facing, wood wall and base units, laminate floors, door leading to rear porch, stairs leading to upstairs.

Rear porch

0.89m x 1.83m (2'11 x 6'0 )

Stairs & Landing

1.85m x 0.91mx2.13m (6'1 x 3x7 )Carpeted stairs and landing

Master bedroom

4.14m x 2.18m (13'7 x 7'2 )Front Facing, carpeted, radiator built in wardrobes.

Bedroom 2

3.71m x 3.48m (12'2 x 11'5 )Rear facing, wood flooring

Bathroom

2.21m x 1.83m (7'3 x 6'0 )Rear facing, laminate flooring, compromising of basin, sink and bath with radiator

External

Rear paved garden with shed.

Tenure

Leasehold

Stamp Duty Land Tax

Residential property rates

You usually pay Stamp Duty Land Tax (SDLT) on increasing portions of the property price when you buy residential property, for example a house or flat.

The amount you pay depends on:

•when you bought the property

•how much you paid for it

•whether you’re eligible for relief or an exemption

Rates for a single property

You pay SDLT at these rates if, after buying the property, it is the only residential property you own.

You will usually pay 5% on top of these rates if you own another residential property.

Rates from 1 April 2025

Property or lease premium or transfer valueSDLT rate

Up to £125,000Zero

The next £125,000 (the portion from £125,001 to £250,000)2%

The next £675,000 (the portion from £250,001 to £925,000)5%

The next £575,000 (the portion from £925,001 to £1.5 million)10%

The remaining amount (the portion above £1.5 million)12%

Example

In April 2025 you buy a house for £295,000. The SDLT you owe will be calculated as follows:

•0% on the first £125,000 = £0

•2% on the second £125,000 = £2,500

•5% on the final £45,000 = £2,250

•total SDLT = £4,750

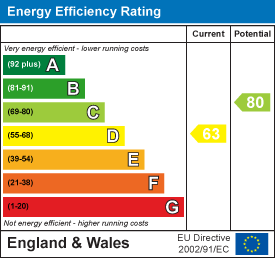

Energy Efficiency and Environmental Impact

Although these particulars are thought to be materially correct their accuracy cannot be guaranteed and they do not form part of any contract.

Property data and search facilities supplied by www.vebra.com